WITH the Federal Senate last week passing the Minerals Resource Rent Tax and its associated legislation, the green light has been given for the planned increase to the superannuation rate paid by employers.

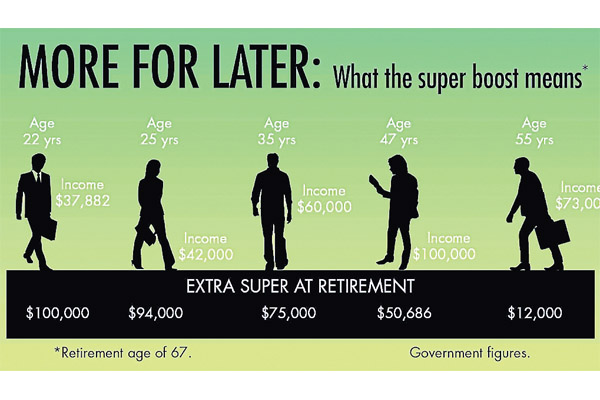

The compulsory super contribution will go from 9per cent to 12per cent and be phased in from 2013 to 2019.

The changes are tipped to benefit more than 8.4million Australian workers.

The changes also provide an extra superannuation contribution to 3.6million Australians on low incomes by handing back the tax they pay on their super for a person with an income up to $37,000.

Australians aged 70 and over will also continue to be entitled to superannuation contributions.

Matthews Steer Chartered Accountants partner and financial planner Geoff Steer said ensuring Australia had more self-funded retirees in the future was essential as the growing proportion of plus-65 year-olds could not all rely on welfare to fund their retirement without major problems to the economy.

He said while today there were about 3-million Australian’s over 65, within 30 years that is expected to jump to 8million.

“That would cause a significant impact if they were still dependent on Centrelink – it would be a major problem.

“It’s clearly going to be an issue for the western world; the need for people to be self-funded in retirement is going to be significant.” Mr Steer said the main question out of the super increase was who paid for it.

“Who bares the cost is clearly the other side of the equation and whether it impacts employment figures.”

Financial Services and Superannuation Minister and Maribyrnong MP, Bill Shorten, said the changes would provide Australians with a more secure and comfortable retirement.

He said the superannuation

reform was underpinned by the increased taxes to super profitable mining companies and would increase the nation’s savings by a $500billion by 2035.

Mr Shorten said the reform would benefit more than 43,000 people in the Maribyrnong electorate.

“Unfortunately, the Coalition voted against these important economic reforms.

“Tony Abbott would prefer to give a tax cut to super-profitable mining company owners than boost the retirement savings of every working Australian.”